closed end credit disclosures

Open-end credit is not restricted to a specific. Sub-sections a and b cover all types of closed end transactions and then the various following subsections have specific.

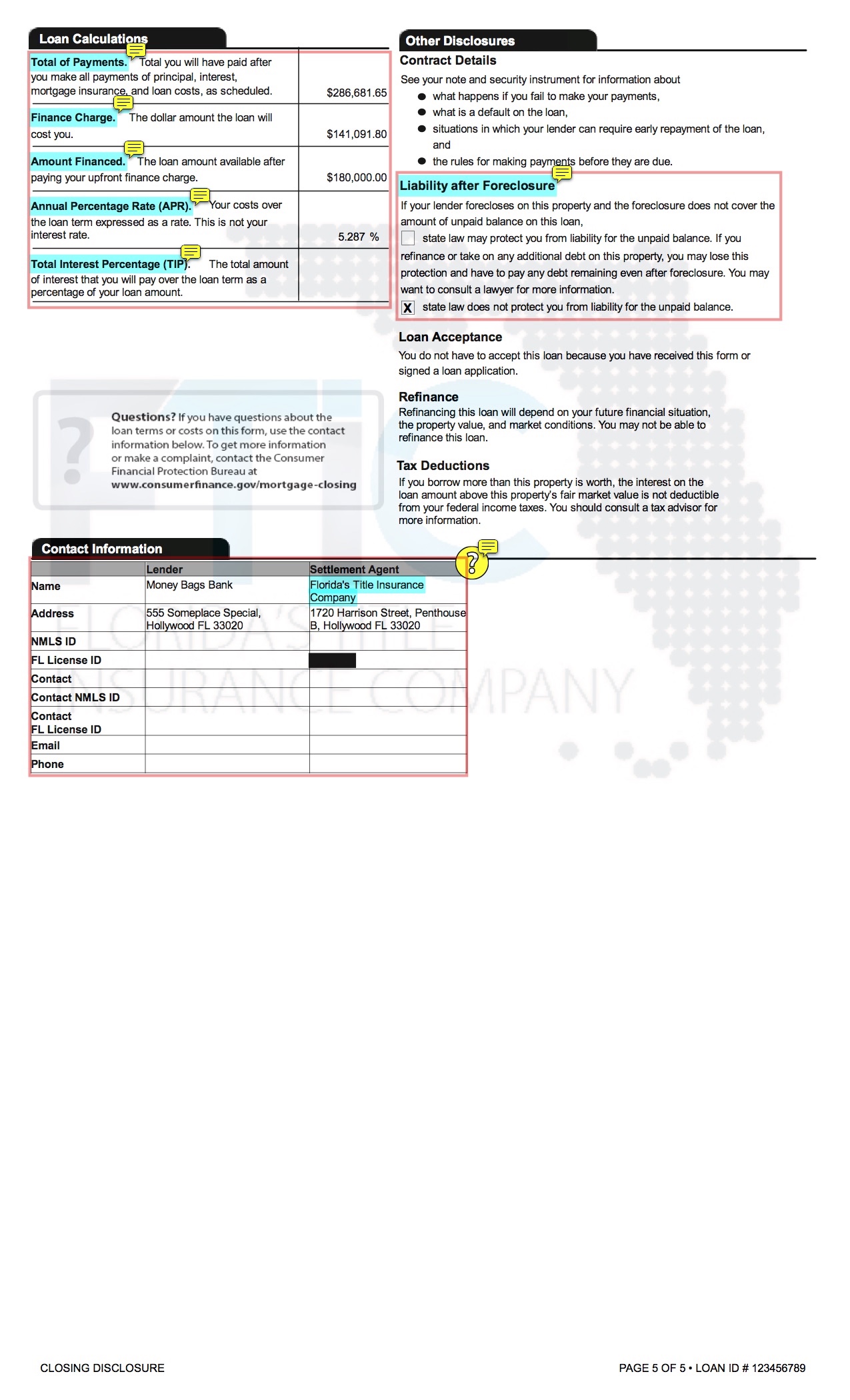

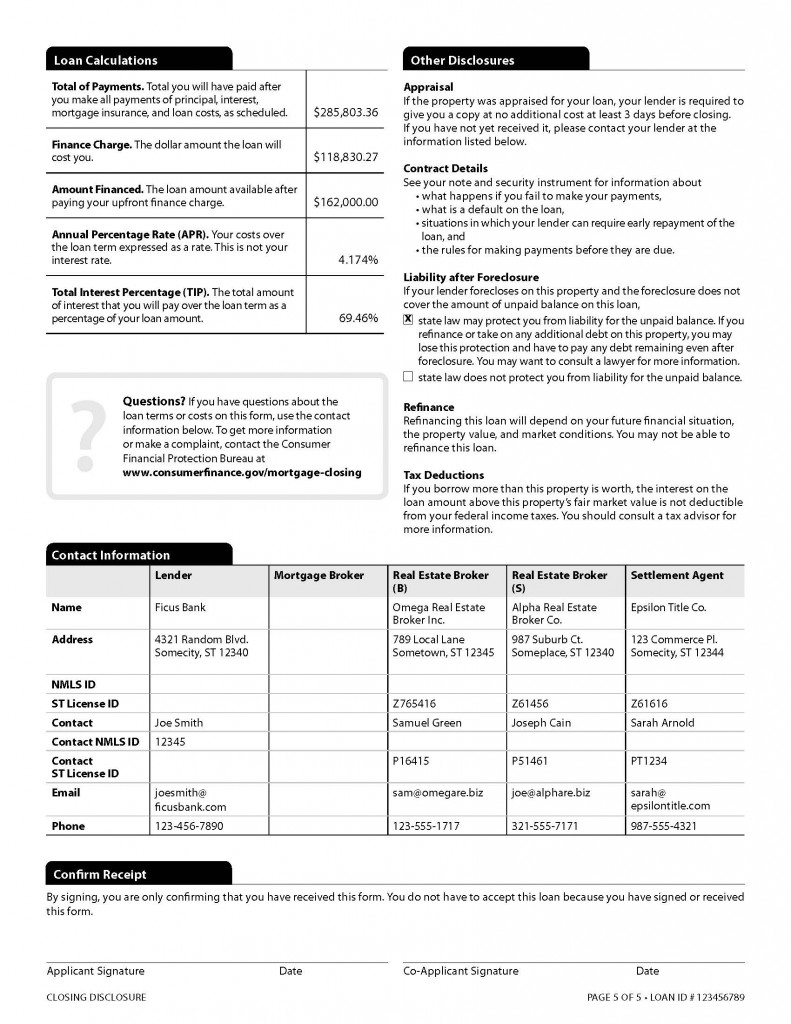

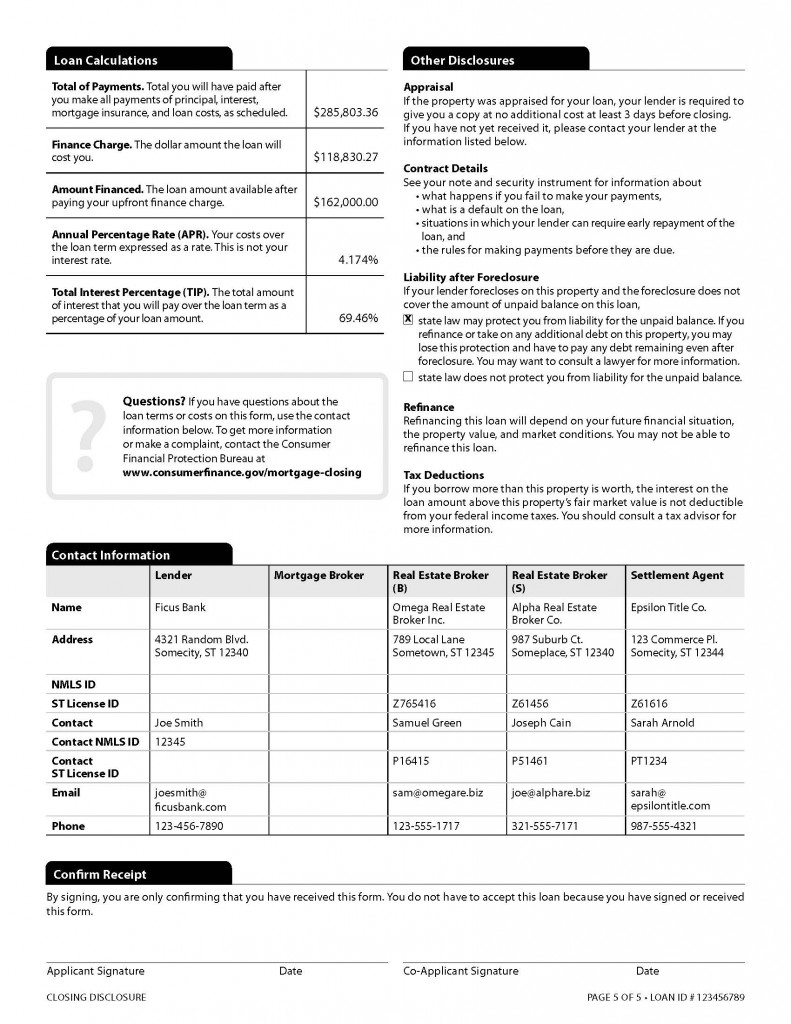

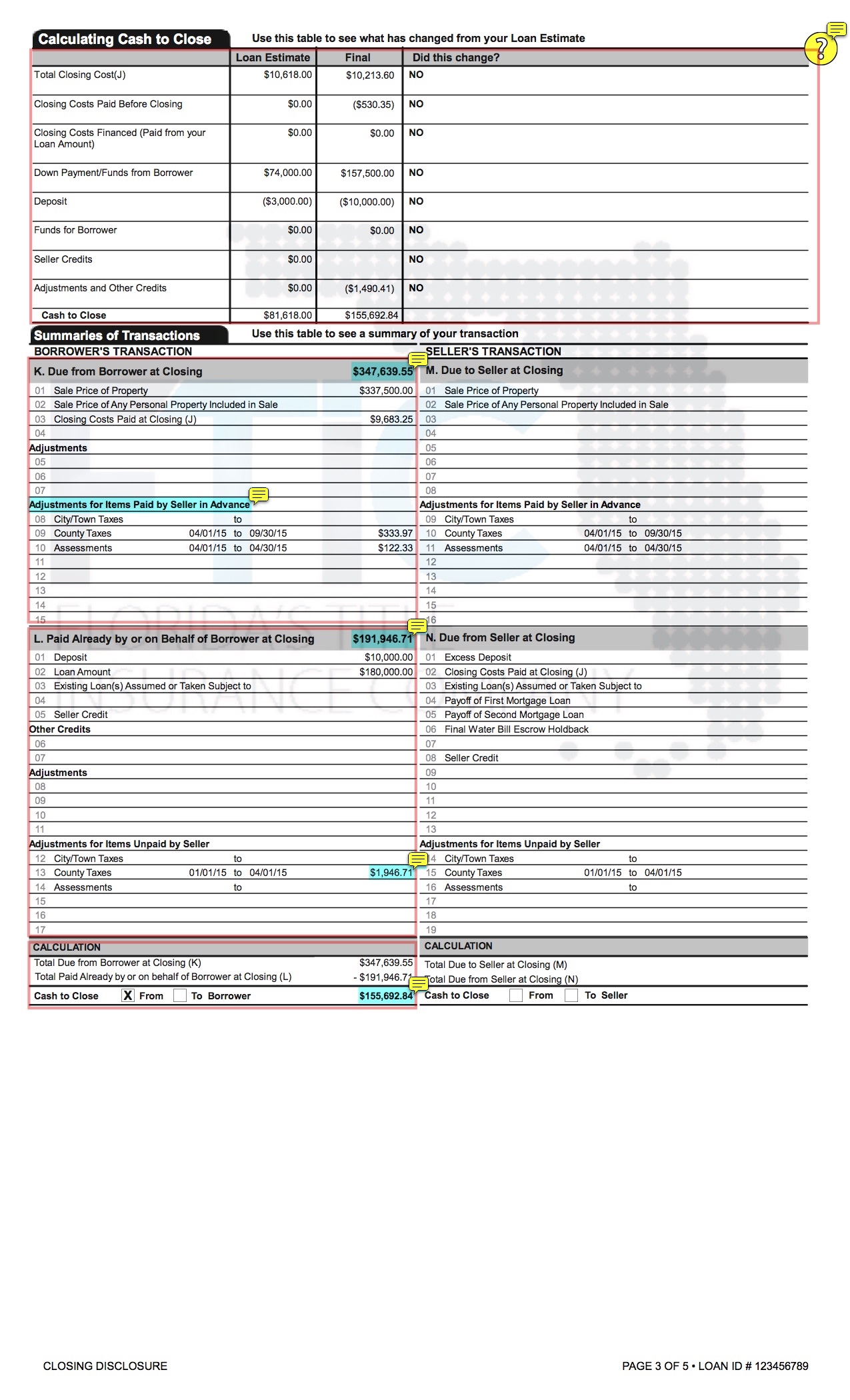

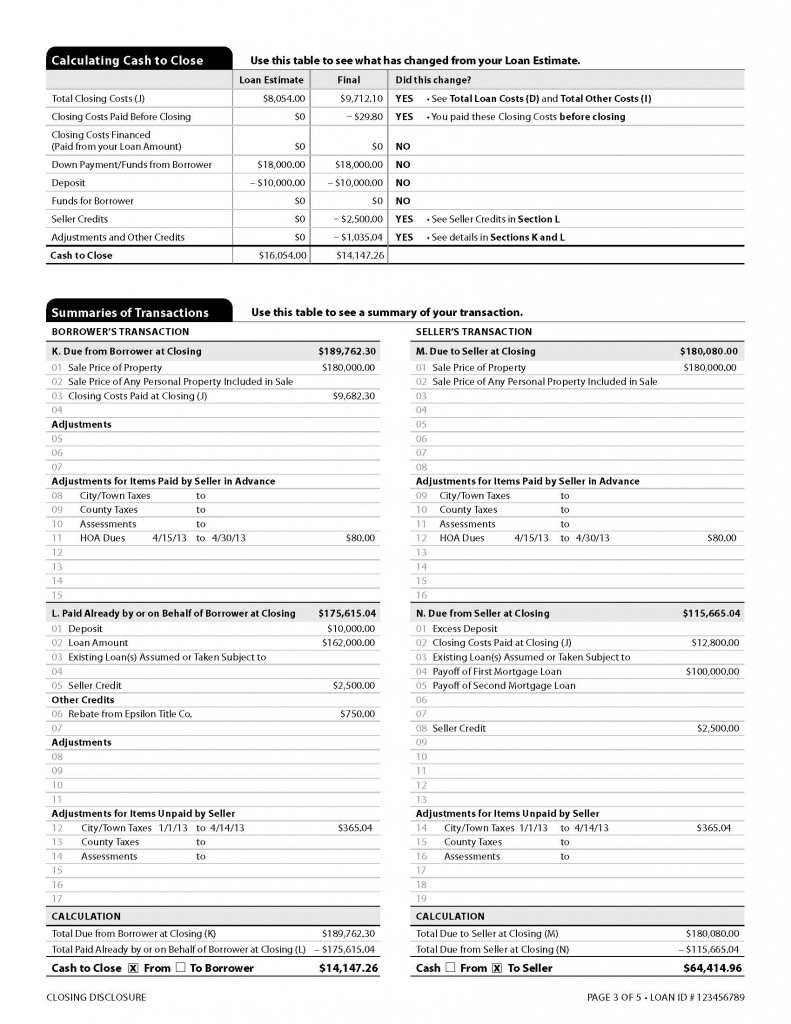

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

CEFs are similar to mutual funds in that investors pool money together to purchase a professionally managed portfolio of securities.

. Trigger terms when advertising a closed-end loan include. In a closed-end consumer credit transaction secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 the creditor shall provide the consumer with. 12 CFR Subpart C - Closed-End Credit.

Unlike mutual funds that continuously offer. Specifically Regulation Z dictates the treatment. 102658 Internet posting of credit card agreements.

Thursday May 19 2022. 2268 is the principal section for closed end credit disclosures. Standard Initial Disclosures all loans UNDERLINED CALHFA Loans.

We are anticipating multiple advances during the term of the credit up to the maximum amount. Closed end credit disclosures. 22617 General disclosure requirements.

The disclosures required under subsection a with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal. 2 The number of payments or period of repayment. 22618 Content of disclosures.

2 nd Lien Closed End Disclosure List. Loan Estimate LE. Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements.

1 The amount or percentage of any downpayment. Besides regulating closed-end credit disclosures TILA and Regulation Z also address other closed-end credit requirements. For a closed-end transaction secured by real property or a dwelling other than a transaction secured by a consumers interest in a timeshare plan described in 11 USC.

Closed end credit such as a mortgage or car loan includes a fixed loan amount. Its different from open end credit such as a credit card which allows borrowers to continue. Credit Score Disclosure except CA loans.

If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. In Lending Disclosures for any closed-end credit single-advance Loan Types will be provided to you separately at or. 102659 Reevaluation of rate increases.

102657 Reporting and marketing rules for college student open-end credit. Intended for all lending personnel this course covers Regulation Zs key disclosure requirements for closed-end non-mortgage. For a closed-end credit transaction subject to 102619e and f opens new window real property or a cooperative unit.

102618 Content of disclosures. We have a personal closed-end line of credit with a term of nine months. 102619 Certain mortgage and variable-rate.

For a closed-end transaction not subject to section 102619e and f determine whether the disclosures are accurately completed and include the following disclosures as applicable. Closed-End Credit Truth In Lending Disclosures Necessary Federal Truth. For a closed-end transaction secured by real property or a dwelling other than a transaction secured by a consumers interest in a timeshare plan described in 11 USC.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written. The Credit Union will comply with the Truth-in-Lending Act and its implementing regulation Regulation Z by providing consumer borrowers with proper Truth-in-Lending disclosures for. 22619 Certain mortgage and variable-rate transactions.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time.

Mandatory Disclosures To Consumer

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

Can I Get A Hud Florida Agency Network

New Mortgage Documents What Are They

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Understanding Finance Charges For Closed End Credit

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Can I Get A Hud Florida Agency Network

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau