iowa city homestead tax credit

Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment year. Homestead Tax Credit Iowa Code chapter 425.

Living Outside The City Has Always Been An Attractive Option For Many But With Housing Prices In Seattle Going Suburbs Washington Things To Do Housing Market

The credit will continue without further signing as long as it continues to qualify or until is is sold.

. Application for Homestead Tax Credit IDR 54-028 111014 This application must be filed with your city or county assessor by July 1 of the year for which the credit is first. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa. To the Assessors Office of _____ CountyCity Application for Homestead Tax Credit Iowa Code Section 425.

November 1 st Agricultural tracts of land 10 acres or more and are farmed by the owner or immediate family members are eligible for this. Dubuque Street Iowa City IA 52240 Voice. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed.

It must be postmarked by July 1. 5 KIRKWOOD CIR IOWA CITY Map this address PDF Name. Disabled Veterans Homestead Application - 54-049a.

In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the property. Property Report PDF file. NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits.

7 enter the tax levy for your tax district x004332624. Disabled Veteran Homestead Tax Credit page 2. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Brad Comer Assessor Marty Burkle Chief Deputy Assessor. Basically the bill is generated by multiplying the assessed value of a property. It is the property owners responsibility to apply for these as provided by law.

Iowa City Assessor 913 S. Upon filing and allowance of the claim the claim is allowed on that. Applications can be completed at our office or obtained online by clicking on Additional.

54-028 012618 IOWA. 52240 The Homestead Credit is available to all homeowners who own and occupy the. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

It is also the property owners responsibility to report to the Assessor when they are no longer eligible for any credit or exemption. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. For properties located within city limits the maximum size is 12 acre where the home and the buildings if.

Homestead Tax Credit 54-028 submission Military Service Tax Exemption Application 54-146 submission. Homestead Tax Credit Sign up deadline. Iowa Special Assessment Credit 54036 Author.

Brad Comer Assessor. Iowa Department of Revenue Created. Dubuque Street Iowa City IA 52240 Voice.

Iowa City Assessor 913 S. Homestead Tax Credit Application 54-028. The document has moved here.

IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Dubuque County Courthouse 720. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed.

This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the disabled veteran tax credit and clarifies the eligibility of a person who has received multiple discharges from service for the disabled veteran tax credit. 54-049b 10192020 FACT SHEET. KIRKWOOD CIRCLE ADDITION LOT 5 Online Signature.

Upon filing and allowance of the claim the claim is allowed on that. Iowa City Assessor 913 S. Dubuque Street Iowa City IA 52240 Voice.

Family Farm Tax Credit. 54-019a 121619 IOWA. The tax year runs from July 1 to June 30 in Johnson County.

Dubuque Street Iowa City IA 52240 Voice. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. Iowa law provides for a number of credits and exemptions.

The Homestead Tax Credit is a small tax break for homeowners on their primary residenceIf you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors SiteYoull need to scroll down to find the link for the Homestead Tax Credit Application. Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. Instantly Find Download Legal Forms Drafted by Attorneys for Your State.

Brad Comer Assessor Marty Burkle Chief Deputy Assessor. The Homestead Tax Credit is a small tax break for homeowners on their primary residence. Upon the filing.

If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. Property tax bills are generated to support citycounty services to taxpayers. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first.

The applicant must own and occupy the property on July 1 st of each year declare residency in Iowa for income tax purposes and occupy the property at least six months each year. What is a Homestead Tax Credit. Military Service Tax Exemption Application 54-146.

Film Industry Tax Incentives State By State 2022 Wrapbook

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Digital News Subscription Tax Credit Who S Eligible And How To Claim It

Available Tax Credits Deductions To Generate Cash Flow

Deducting Property Taxes H R Block

Business Deductions For The Self Employed 12 Overlooked Tax Deduction Tips

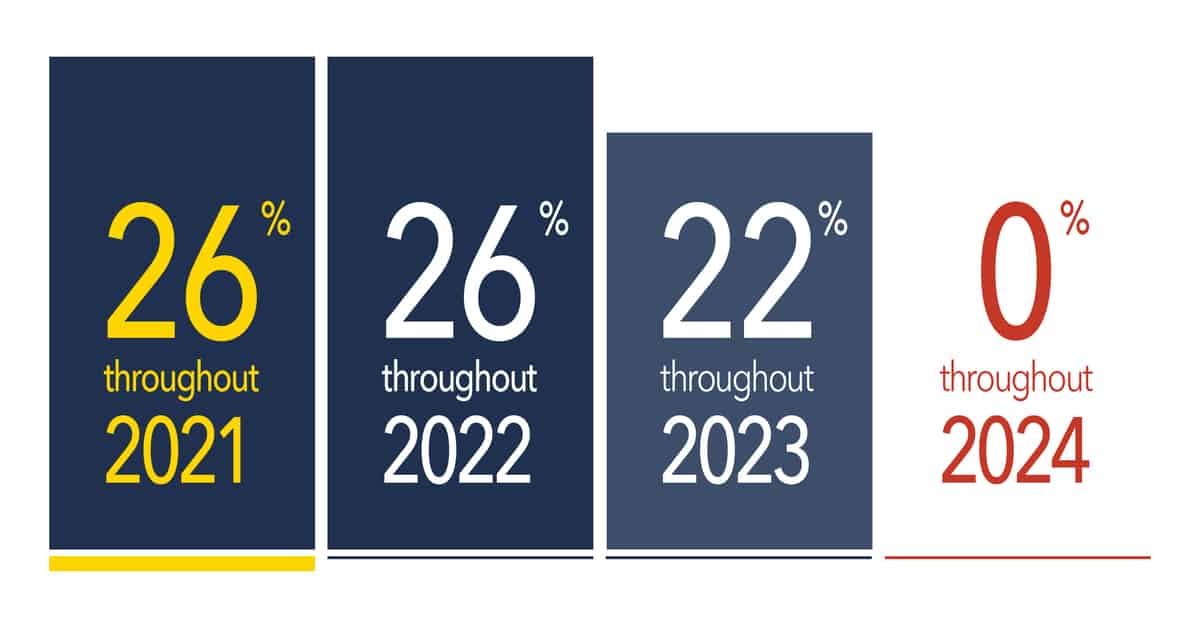

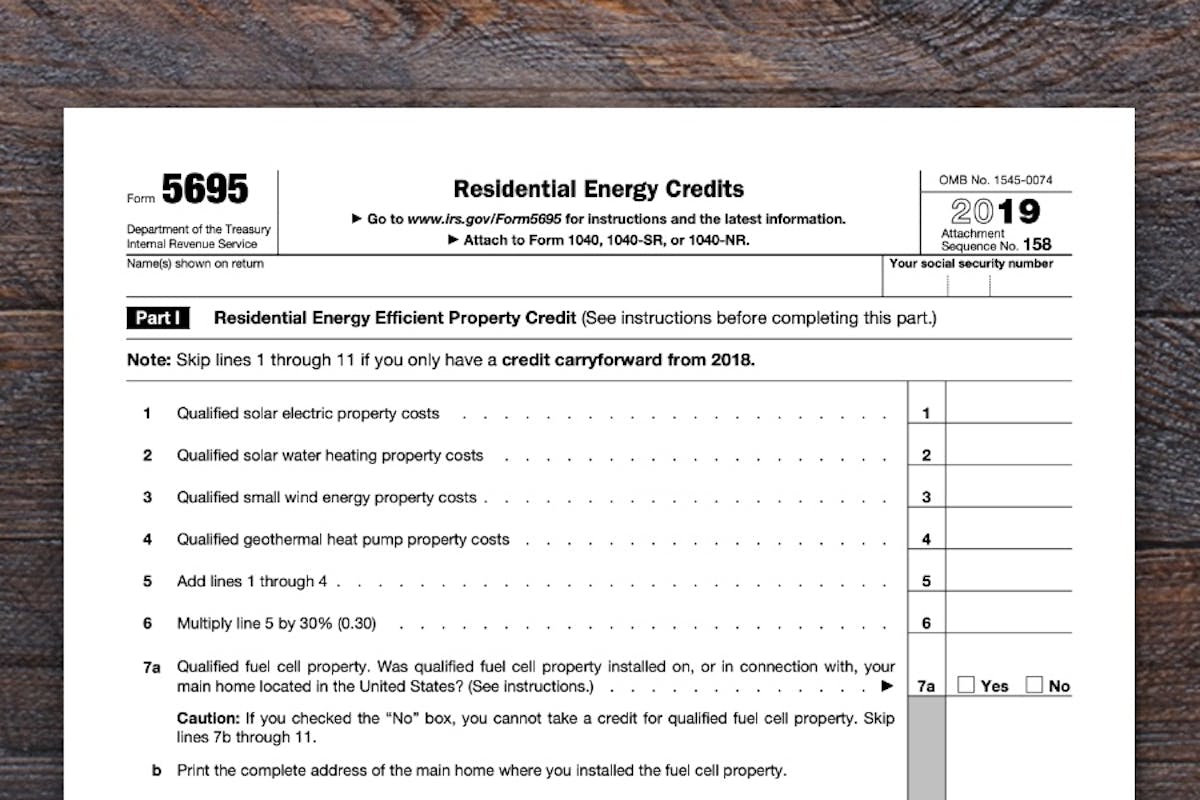

The Federal Geothermal Tax Credit Your Questions Answered

Everything You Need To Know About The Solar Tax Credit Palmetto

More Childless Adults Are Eligible For Earned Income Tax Credit Eitc

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Tax Exemption Smartasset

American Opportunity Tax Credit H R Block

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow