unified estate and gift tax credit 2021

Gift Tax Annual Exclusion. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

Estate And Gift Taxation Law T 510 University

The 117 million exception in 2021 is set to expire in 2025.

. Estate Tax Exemption Basic Exclusion Amount 11700000. The unified credit was 4577800. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

If you need more information about the unified tax credit use our free legal tool below. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Start Your Tax Return Today.

A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. In 2022 the combined credit against estate and gift tax will be 12060000 an increase from 117 million dollars in 2021 according to the IRS. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due.

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied. A key component of this exclusion is the basic exclusion amount BEA. The lifetime exemption was worth 117 million for tax year 2021.

Generation-Skipping Transfer GST Tax Exemption. The 117 million exception in 2021 is set to expire in 2025. As of 2021 the federal estate tax is 40 of the inheritance amount.

The 2021 federal tax law applies the estate tax to any amount above 117 million. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit.

The annual gift tax exclusion amount remains 15000. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. The estate and gift tax exemption is.

The previous limit for 2020 was 1158 million. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. This means that when someone dies and the value of their estate is calculated any.

The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Ad All Major Tax Situations Are Supported for Free.

What Is the Unified Tax Credit Amount for 2021. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. The previous limit for 2020 was 1158 million.

Access IRS Tax Forms. Max refund is guaranteed and 100 accurate. As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift.

Any tax due is determined after applying a credit based on an applicable exclusion amount. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied. The estate and gift taxes are based on a series of graduated rates that start at 18.

As we discussed in more detail here Congress previously proposed as part of the Build Back Better Act accelerating the sunset of the exemption to January 1 2022 and essentially. Any tax due is determined after applying a credit based on an applicable exclusion amount. What Is the Unified Tax Credit Amount for 2021.

This of course could remain subject to change. The gift tax and the estate tax share the same exemption often referred to as the unified tax credit. Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million.

Free means free and IRS e-file is included. Complete Edit or Print Tax Forms Instantly. The unified tax credit is designed to decrease the tax bill of the individual or estate.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. What Is the Unified Tax Credit Amount for 2021. The Estate Tax is a tax on your right to transfer property at your death.

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. It increased to 1206. The previous limit for 2020 was 1158 million.

Gift and Estate Tax Exemptions The Unified Credit. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or.

The extent of the benefit provided by the unified tax credit depends on the tax year in which you intend to use the credit. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax.

For 2021 the estate and gift tax exemption stands at 117 million per person. Taxable Income Threshold at which Highest Rate Applies for TrustsEstates. Wednesday January 20 2021.

The tax is then reduced by the available unified credit. How Might the Biden Administration Affect the Unified Tax Credit. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed.

Then there is the exemption for gifts and estate taxes. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. What is the unified tax credit for 2022.

The 2017 Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. For 2021 that lifetime exemption amount is 117 million. So individuals can pass 117 million to their heirsand couples can transfer twice that amountwithout.

Get information on how the estate tax may apply to your taxable estate. A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. For 2021 that lifetime exemption amount is 117 million.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years.

This is called the unified credit. Beginning in 2022 the annual gift exclusion will be 16000 per donor an increase over the previous years 15000 limit.

Build Back Better Act Trusts And Estates

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

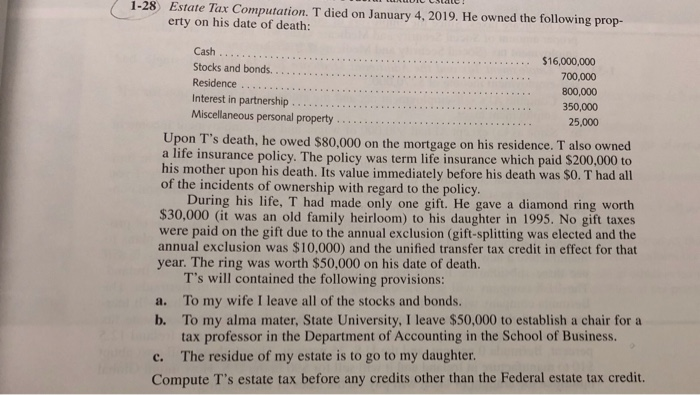

1 28 Estate Tax Computation T Died On Erty On His Chegg Com

Estate And Gift Taxation Law T 510 University

Estate And Gift Taxation Law T 510 University

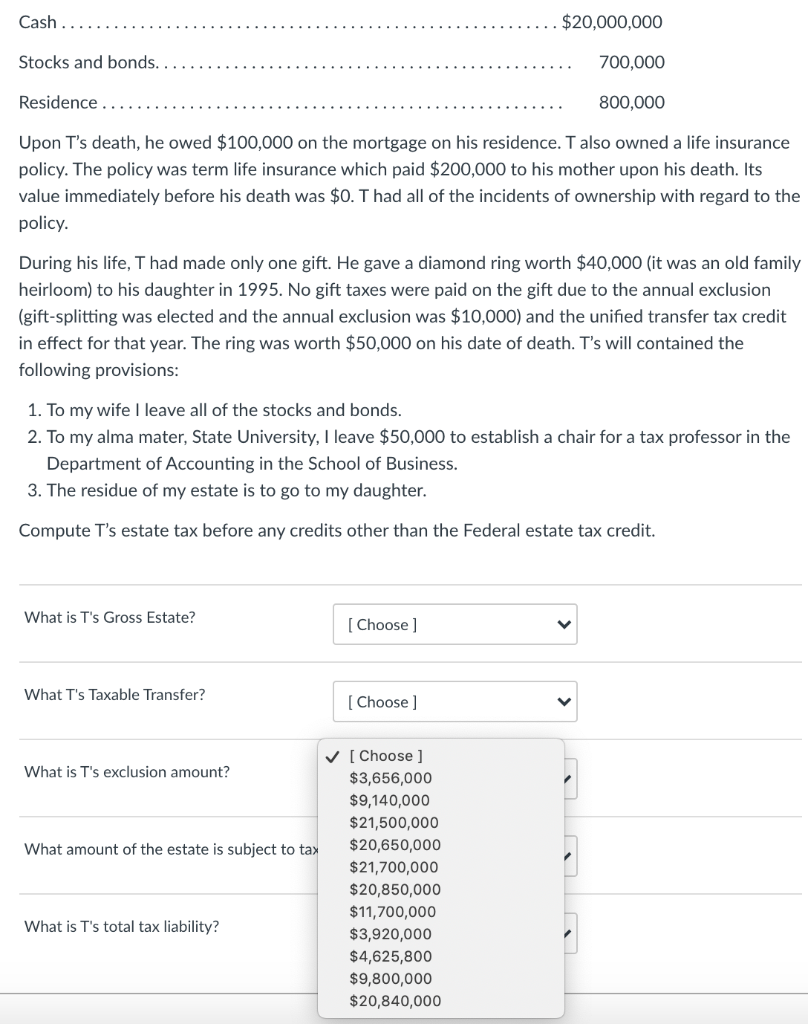

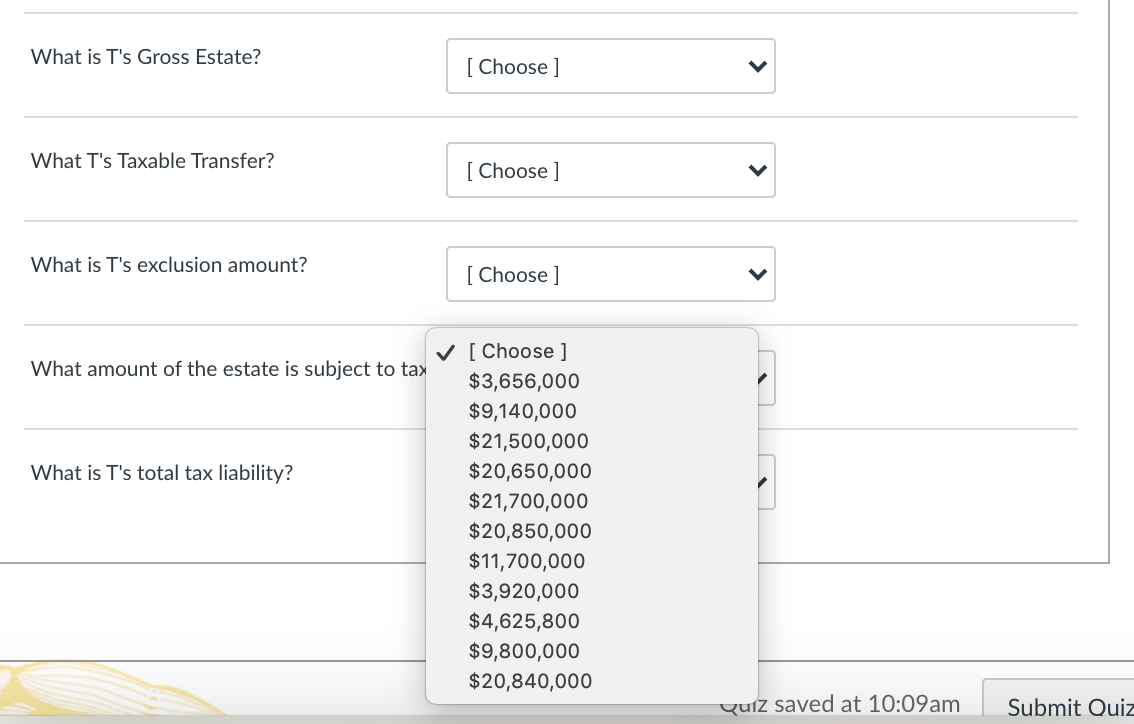

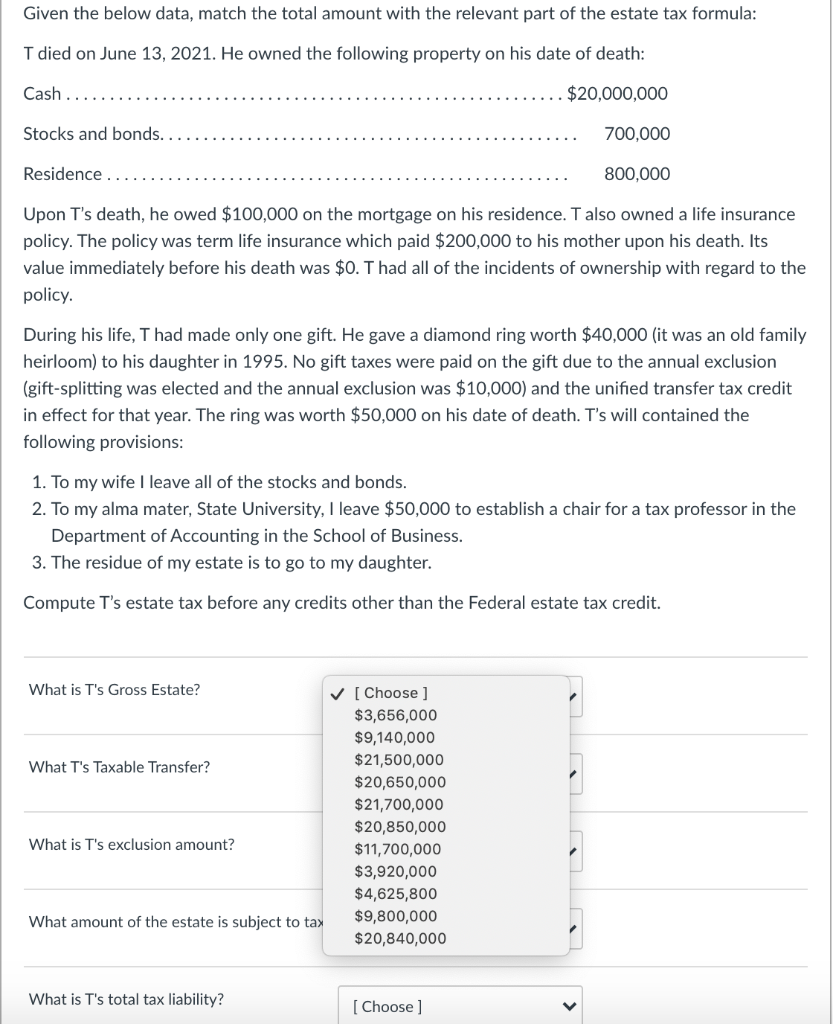

Given The Below Data Match The Total Amount With The Chegg Com

Estate And Gift Taxation Law T 510 University

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

Given The Below Data Match The Total Amount With The Chegg Com

Estate And Gift Taxation Law T 510 University

Should You Gift Stocks As Part Of Your Estate Plan Legacy Design Strategies An Estate And Business Planning Law Firm

U S Estate Tax And Residents Of Switzerland Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Florida Attorney For Federal Estate Taxes Karp Law Firm

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Given The Below Data Match The Total Amount With The Chegg Com

Estate Tax Planning Graber Johnson Law Group Llc

Estate And Gift Taxation Law T 510 University

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel